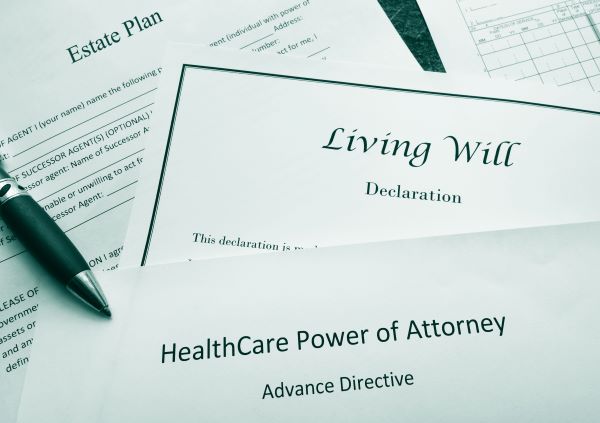

Planning an Estate: The Major Components

In an estate plan, assets are distributed in accordance with your wishes, and your loved ones are provided for after your death. It requires organization and strategy and begins with five key legal documents that can address many areas of…