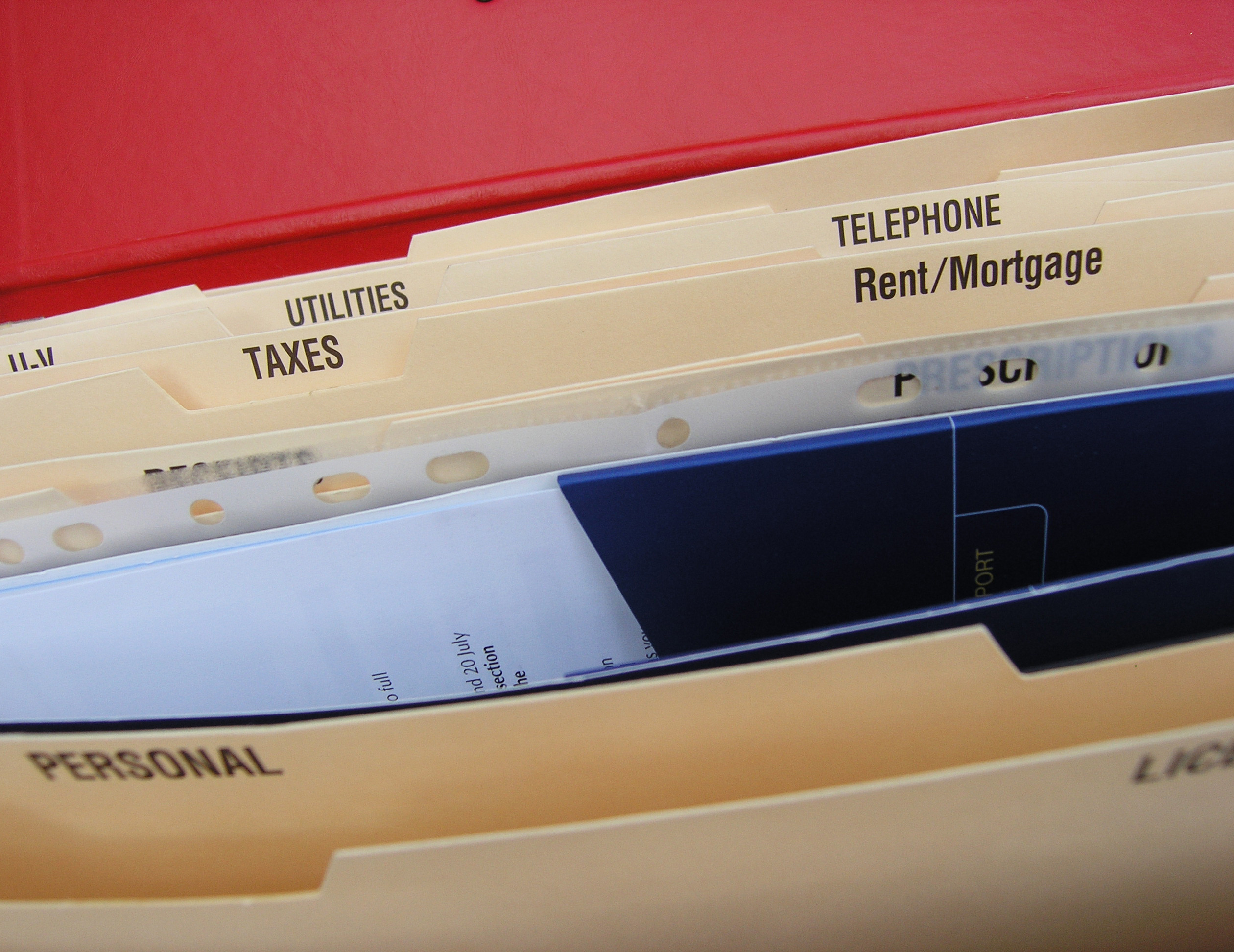

Estate Planning: Should I Divide My Assets Equally?

Even if your children get along well, the distribution of your assets can require conflict resolution skills. Without previously experiencing any significant conflicts, even close siblings can struggle to maintain happy family relationships when settling your estate.